- INFRA INSIDER

- Posts

- ⚡Inside xAI's 1.2 Gigawatt Leap: Can Musk Really Build the World's Most Powerful AI Campus in a Year?

⚡Inside xAI's 1.2 Gigawatt Leap: Can Musk Really Build the World's Most Powerful AI Campus in a Year?

Inside Musk’s race to power 1 million GPUs—and the grid-bending, gas-fueled, globally-watched sprint to get there

Quick Bytes

🚀 xAI aims to boost Colossus from 250 MW to 1.2 GW—that’s nearly 5x more power, rivaling the DeLorean's 1.21 gigawatts from Back to the Future.

🔥 Temporary gas turbines are key—xAI could deploy up to 60 large turbines for rapid 950 MW growth while battling environmental scrutiny.

⚡ Permanent grid power buildout could take 2–3 years, requiring 4–6 new substations or an on-site gas plant—$150M+ investment likely.

💡 Musk moves fast—100K GPUs in 122 days, another 100K in 92. With Tesla Megapacks and $1B NVIDIA deal, xAI’s urgency is real.

🌍 New capacity alert—Over 90 MW across U.S. and Nordic sites coming online in 2025–2026, including 50 kW/rack and renewable options.

📅 Need data center capacity for AI workloads? Let’s talk. Book a meeting today.

Building the 1.2 Gigawatt xAI Data Center in 2025

Expanding the power capacity at xAI’s Colossus supercomputer in Memphis from 250 megawatts (MW) to 1.2 gigawatts (GW)—a nearly fivefold increase—is a complex challenge involving infrastructure, logistics, and regulatory hurdles. The Memphis XAI site has existing resources (like natural gas availability at the old Electrolux factory). This assumes typical industry constraints.

Current State and Past Expansion

Colossus initially launched in September 2024 with 100,000 NVIDIA H100 GPUs, requiring about 150 MW, approved by the Tennessee Valley Authority (TVA) in November 2024. By December 2024, xAI doubled this to 200,000 GPUs and increased power to approximately 250 MW. This was reported by Elon Musk and Memphis Light, Gas and Water (MLGW) in January/February 2025.

This ramp-up from 150 MW to 250 MW occurred over roughly six months (June 2024, when the project was announced, to December 2024), though much of the initial 150 MW infrastructure was in place by September. The additional 100 MW was largely supported by temporary gas turbines and Tesla Megapacks, with MLGW boosting grid capacity to 50 MW by August 2024 and xAI funding a $24 million substation for the full 150 MW, expected to be operational in 2025.

This suggests xAI added ~100 MW in about three months (September to December 2024), averaging ~33 MW per month, though this relied heavily on temporary solutions and pre-existing grid upgrades. Permanent infrastructure (e.g., the substation) took longer, with the 150 MW substation projected for completion in 2025—roughly 12–18 months from announcement to operation.

The new power target for the xAI data center is 1.2 Gigawatts. The Back to the Future movie needed 1.21 Gigawatts to power the deLorean time travel circuit.

Reaching 1.2 GW (1,200 MW) from 250 MW requires an additional 950 MW. This scale is unprecedented for a single site in such a short timeframe, equivalent to the output of a large natural gas power plant. The old Electrolux factory at 3231 Paul R. Lowry Road has access to a 16-inch natural gas main and is near industrial neighbors like Nucor Steel and a wastewater treatment plant, offering some resource advantages.

Here are the main options for getting the power.

1. Temporary Power (Gas Turbines)

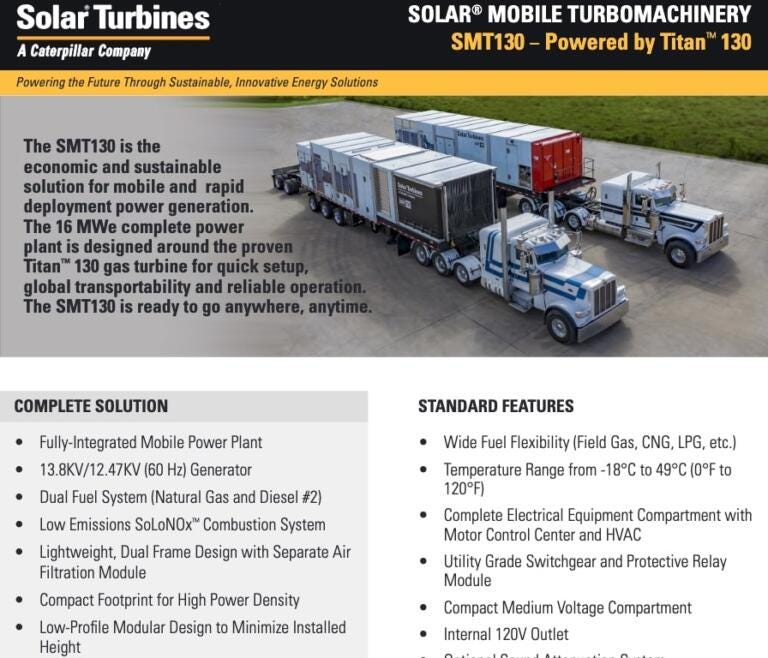

Feasibility: xAI has already deployed 17–18 gas turbines (e.g., Voltagrid’s 2.5 MW units and Solar Turbines’ 16 MW SMT-130s) to bridge gaps, generating ~35–70 MW currently. xAI plans to lean on gas turbines further, with a permit filed in January 2025 for 15 turbines to run 24/7 through 2030, emitting ~11.51 tons of hazardous air pollutants annually.

For higher power requirements, the SMT130 is the economic and sustainable solution for mobile and rapid deployment power generation. This 16 MWe complete power plant is designed around the proven Titan 130 gas turbine for quick setup, global transportability, and reliable operation.

Capacity: To hit 950 MW, xAI could deploy ~380 additional 2.5 MW turbines or ~60 additional 16 MW turbines. Procurement and installation of this many units could take 3–6 months, given xAI’s demonstrated speed (e.g., 17 turbines installed by summer 2024). Natural gas availability from the existing main supports this. Pipeline capacity limits are unclear.

Speed: If xAI replicates its 100 MW in three months pace, 950 MW could theoretically take 9–12 months (late 2025 to early 2026), assuming no supply chain bottlenecks. However, environmental pushback (e.g., from the Southern Environmental Law Center) and EPA scrutiny since October 2024 could delay permits, adding 3–6 months if enforcement actions escalate.

2. Permanent Grid Power

Infrastructure Needs: 1.2 GW far exceeds MLGW’s current capacity. Peak summer demand in Memphis is ~3,000 MW, and Colossus at 1.2 GW would consume 40% of that alone. MLGW’s CEO noted in January 2025 that even 300 MW (xAI’s Phase 1 and 2) strains the grid, requiring a second substation. Scaling to 1.2 GW likely needs 4–6 new substations and major transmission upgrades, potentially a dedicated power plant.

Timeline: The 150 MW substation took ~12–18 months from planning (mid-2024) to projected completion (late 2025). Scaling to 950 MW could take 24–36 months (mid-2027) for grid upgrades alone, based on industry norms—e.g., TVA’s proposed 200 MW gas plant addition in 2023 took over a year to plan. xAI’s $24 million substation build suggests they can accelerate this, but 950 MW might cost $150–300 million and still require 18–24 months with TVA approval (mandatory over 100 MW).

Natural Gas Proximity: Proximity to gas infrastructure could support a new on-site gas plant (e.g., 1 GW combined-cycle plant), cutting grid reliance. Construction typically takes 24–36 months, but Musk’s urgency might compress this to 18–24 months with pre-fabricated units, starting mid-2025 and finishing late 2026–early 2027.

3. Hybrid Approach (Likely Scenario)

xAI’s pattern suggests a mix of temporary and permanent solutions. They could deploy 300–500 MW of gas turbines by late 2025 (9–12 months from now) while building grid capacity or a gas plant for the rest. This aligns with posts on X claiming a 1.2 GW target and Musk’s December 2024 pledge to expand to 1 million GPUs by 2026, implying power must be ready by then.

Pace: Adding 300 MW via turbines in 9 months (33 MW/month) gets to 550 MW by November 2025. The remaining 650 MW via grid/plant could lag to 2027 unless xAI secures expedited approvals and pre-built hardware, potentially hitting 1.2 GW by late 2026.

Constraints and Accelerators

Constraints: MLGW’s grid is stretched—2022 blackouts highlight reliability issues. TVA’s review of xAI’s second 150 MW phase (due February 2025) may flag capacity limits, and environmental resistance could stall gas turbine permits. Chip and turbine supply chains (e.g., NVIDIA B200s, Solar Turbines) also pose risks.

Accelerators: xAI’s $1.08 billion NVIDIA deal (January 2025) and Memphis’s support (e.g., dedicated xAI team) signal priority. Musk’s history—Colossus built 100K GPUs in 122 days and added another 100,000 in 92 days. They leased existing gas plants and are using Tesla Megapacks for energy bursts.

Best Estimate

Fastest Scenario: About 9-12 months. Starting in January 2025 could see completion by October 2025 or Dec 2025) with 500-950 MW of turbines by late 2025 and/or 700 MW of grid/gas plant by mid-2026, assuming Musk gets past regulatory and supply hurdles.

Given xAI’s six-month sprint to 250 MW relied on temporary fixes, hitting 1.2 GW by early 2026 is ambitious but plausible if they prioritize turbines and parallel-track a gas plant.

The Evolution of AI: From Perception to Physical Intelligence

NVIDIA's GTC keynote presented a compelling evolution of AI through four progressive stages: perception AI → generative AI → agentic AI → physical AI. Each builds upon the previous, creating a foundation for increasingly sophisticated applications. Let’s look at each stage.

Perception AI interprets the world through computer vision, speech recognition, and sensor data. This technology thrives at the edge - in phones, cameras, manufacturing facilities, and autonomous vehicles - requiring ultra-low latency and distributed computing architectures.

Generative AI creates new content across text, images, audio, video, and code. Since ChatGPT's launch in November 2022, these tools have revolutionized productivity across industries. The infrastructure demands are enormous, requiring massive GPU clusters, unprecedented memory and bandwidth, connectivity innovations, and cooling solutions for 100MW+ facilities.

Agentic AI represents a shift from reactive to proactive systems that can reason and act autonomously. These agents operate in continuous loops, handling complex tasks like trip planning or sales follow-ups without human intervention. The infrastructure implications include token explosion (100x more), continuous workloads, increased networking pressure, and the rise of "AI factories" with many thousands of GPUs.

Physical AI brings artificial intelligence into the physical world through robotics and automation. These systems require a hybrid approach to infrastructure: edge computing for real-time decision making and centralized GPU clusters for continuous learning and improvement. The challenges include multimodal inferencing - processing diverse data input formats simultaneously.

Throughout this progression, infrastructure requirements have evolved dramatically - from edge computing to hyperscale data centers, from air cooling to liquid immersion, and from isolated systems to interconnected AI factories. As we approach the age of embodied intelligence, these technological advances promise exponential gains in productivity across manufacturing, transportation, healthcare, and everyday life.

New Capacity Opportunities For 2025 and Beyond

Two 15 MW sites in the mid-west region of the United States

Air-cooled

6.5 cents per kW-hr

Ready for service in Q3 of 2025

30 MW in the central region of the United States

Ready for service toward the end of 2025

50 kW/rack density

Expanding to several hundred MW

Two sites in the Nordics: 20 MW and 12 MW

Ready for service in 2026

Renewably powered

Ready for pre-lease

The above sites are great for large-scale deployments and we have plenty of inventory for those that need a few megawatts or hundreds of kilowatts of capacity. What kind of infrastructure are you looking for? Book time here with our team to learn about what’s available.

Your Feedback Matters

At Infra Insider, we’re here to give you an edge—exclusive insights into the evolving infrastructure world that others miss. While most newsletters skim the surface, we go deeper, spotlighting the trends shaping AI, data centers, and tech capacity. Think behind-the-scenes intel, key players driving change, and actionable updates straight from the field. It’s not just another industry briefing—it’s your front-row seat to the future.

Your feedback is crucial in helping us refine our content and maintain the newsletter's value for you and your fellow readers. We welcome your suggestions on how we can improve our offering; [email protected].

Nina Tusova

Director of Customer Relationship & Success // Team Ignite

Did this newsletter bring the heat or just a little spark? Rate the intel! |

Reply