- INFRA INSIDER

- Posts

- 💣 AI’s Trillion-Dollar Tsunami: How The AI Arms Race Is Reshaping the World 🌎

💣 AI’s Trillion-Dollar Tsunami: How The AI Arms Race Is Reshaping the World 🌎

With spending hitting the trillions, the fight for AI dominance is just getting started. Here's why it matters.

Quick Bytes

🚀 AI Spending Surges – Annual AI investment is jumping from $350B to trillions, reshaping industries and boosting Nvidia, Microsoft, Apple, Amazon, Google, and Tesla.

🤖 CEOs Bet Big on AI – Investing in AI means huge gains, while not investing risks falling behind. Leaders are doubling down without waiting for returns.

💰 Big Tech’s AI War Chest – Meta, Microsoft, Amazon, and Google will pour $320B into AI infrastructure in 2025, while XAI raises $10B at a $75B valuation.

⚡ The AI Power Grab – Hyperscalers race to deploy GPUs and expand data centers as Microsoft alone may push AI spending to $250–300B yearly.

📈 AI Pays Off Now – Microsoft, Google, and Meta report massive AI-driven revenue, with AI-generated code and ads boosting billions.

🌎 NVIDIA GTC 2025: AI’s Next Leap – Key trends: Enterprise AI, liquid cooling, robotics, automation, and AI-powered energy.

🏗 Additional New Data Center Capacity –

✅ 6MW in Silicon Valley – Available now

✅ 50MW + 25MW in the Midwest – Ready 2027

✅ 1GW pre-lease in Japan, UK, Brazil

📅 Secure AI-ready infrastructure before it’s gone! Book a meeting today.

$350 Billion Per Year For AI Increasing to Trillions Per Year

AI spending is huge and it is sustainable and has indications that it is profitable spending. This has huge implications for the share prices of Nvidia, Microsoft, Apple, Amazon, Meta, Google, Tesla , XAI, Broadcom and TSMC. It is also has implications for imminent superintelligence and civilization getting reshaped over the next few years and beyond.

Returns are from AI are being seen. The smaller spending from 2 years ago sees a lag in returns but adjusting for lag shows profits.

Pascal’s Wager Applied (CEOs Believe in Godlike AI)

Invest and AI Succeeds: Huge payoff—competitive advantage, innovation leadership, and returns on investment (e.g., breakthroughs in compute-intensive tasks like drug discovery or climate modeling). The cost of building data centers is dwarfed by the benefits.

Invest and AI Fails: Loss of capital—money spent on infrastructure, energy, and maintenance yields little return. The cost is significant but finite.

Don’t Invest and AI Succeeds: Missed opportunity—competitors or other nations dominate, and you’re left behind in a potentially world-altering technological shift. The regret and strategic disadvantage could be catastrophic.

Don’t Invest and AI Fails: Minimal loss—you save resources and avoid a sunk cost, but there’s no gain either.

The BG2 podcast (with semiconductor , AI analyst Dylan Patel) describe the AI investment.

This was an AI scaling and spending discussed by multi-billion fund managers Bill Gurley and Brad Gerster with top AI analyst Dylan Patel.

Free cashflows from Meta, Microsoft, Amazon, Google and other are going into AI data centers and AI research.

There is a discussion of capex spending of hyperscalers (the capex investment part of the discussion of BG2).

Gurley’s broader narrative aligns with analyses from sources like Morgan Stanley and Dell’Oro Group, which project hyperscaler CapEx reaching $300–$335 billion in 2025, largely driven by AI. For instance, Morgan Stanley’s updated forecasts (reported February 20, 2025, via Datacenter Dynamics) estimate Amazon and Microsoft leading with $96.4 billion and $89.9 billion, respectively, in 2025 CapEx, with AI infrastructure as a primary driver. Gurley’s discussions in prior years suggest he views this as a strategic necessity.

$320 billion in spending from the top four companies in 2025 CapEx projections:

Amazon - $100 billion, up from $83 billion in 2024

Microsoft - $80-90 billion, up from $55 billion

Google - $75 billion, up from $52.5 billion

Meta - $65 billion, an increase from $39 billion

XAI is raising $10 billion at $75 billion valuation. XAI will successfully raise and then will raise again. My estimate $30-40 billion at $200-300 billion valuation later in 2025.

XAI will build and is building for Grok 4. In the first two months of 2025 XAI already has 2.5X the Grok 3 100K H100s compute cluster. Chips and energy already installed for the 200K chips. The natural gas turbines to double power is already bought and is installing. This 2025 build is committed and will happen, fundraising is certain. My projection of the 400K GPU expansion is purchased is installing (power and chips) 3 months.

The 1M GPU will be installed (another 600K chips) and 1.2 GW (another 700 MW) will get money and built by the end of 2025. Bets are being made without waiting to see results or returns from prior bets. Pascals AI wager.

Big Tech CEOs See Value

For the October–December 2024 quarter, Microsoft reported a 10% increase in profit and a 12% revenue increase to $69.6 billion, with earnings before interest and taxes (EBIT) up 17%. CEO Satya Nadella noted that the AI business surpassed a $13 billion annual revenue run rate, up 175% year-over-year, suggesting significant topline growth driven by AI. [AI Is paying now and paying off more, but the landgrab and competition forces putting all winnings and more ahead of the growing payoff rate]

Cash Flow Resilience: Even with the CapEx surge, Microsoft generated $74.07 billion in free cash flow in fiscal 2024, up 24.5%, indicating that its financial health remains robust despite the spending.

Google’s AI investments are showing early returns, with over 25% of new code generated by AI internally, boosting operational efficiency. Cloud growth is partly attributed to “accelerated growth” in AI products, indicating some monetization success.

Meta integrates AI into its platforms. The rapid uptake of AI tools by advertisers (4 million users, up from 1 million in six months) shows real-time returns, particularly in ad targeting. Analysts like JPMorgan’s Doug Anmuth note that “the return on AI investments is more apparent in Meta’s core advertising business” than in Google’s cloud.

Value of AI investment, the $20 billion investment 2 years ago results in $10 billion per year on average for the next 3 years. They are getting positive return BUT they are reloading with $80-90 billion now which could pay off with $30-50 billion per year for 3 years. But they will go with more investment at $150 billion per year in 2027-2028.

Deepseek is claiming 85% margins. $200 million per year.

Hyperscaler and other AI companies can and will also tap into the sovereign wealth funds.

The dot.com era Internet and Cisco and network spend had a delay in the payoff after the temporary overbuild. But those ended up paying off.

2024 FCF: The Magnificent 7 collectively generated an estimated $350–400 billion in free cash flow in 2024, with approximate individual contributions as follows (based on the most recent data):

Apple: ~$108.8 billion

Microsoft: ~$74.1 billion

Alphabet: ~$72.8 billion

Meta: ~$54.1 billion

Amazon: ~$50.1 billion

NVIDIA: ~$39.2 billion

Tesla: ~$3.5 billion (quarterly annualized is $8-9 billion)

All the free cashflow is after R&D and capex.

2026 is when the current bets and spending must payoff. My calculations and Dylan is that the models will get better and payoff. But my prediction is that XAI and Tesla could get better AI and better returns. So the fact that the total investments should pay, returns will not be equal.

Dylan at 1 hour 24 says they (Big Tech) will take free cashflow to zero by increasing AI spending.

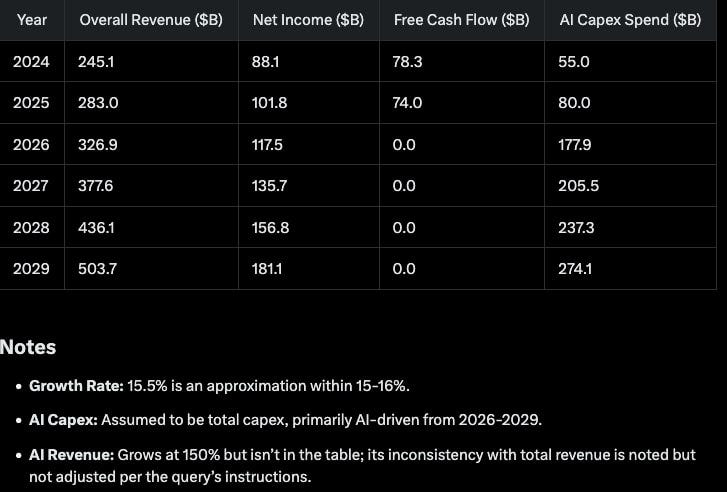

If this happened for Microsoft, then it would mean increasing AI and research to about $250-300 billion from Microsoft alone. The 15% per year growth in revenue and net income could support the growing investment shown below.

The other BIG tech companies have similar growth rates and combined they will be able to head to over $1 trillion per year in AI spend / data center capex spend. This would be a sustainable use of free cashflow generated by growing businesses.

NVIDIA GTC 2025: Four Essential Themes Shaping the AI Revolution

As you read this, the Ignite and Filos Teams are busy soaking up as much of NVIDIA’s GPU Technology Conference (GTC) as possible. We are at sessions to learn from experts and meeting with our current and soon-to-be partners to explore opportunities for collaboration. This article is about four key areas where NVIDIA continues to shape the AI revolution that will be highlighted at GTC.

This area focuses on how AI is becoming truly enterprise-ready with immediate ROI potential. Generative AI and AI agents are transforming business operations through customer service automation, 24/7 cybersecurity monitoring, fraud detection, and personalized marketing. While scaling from proof-of-concept to full deployment remains challenging, cloud providers and edge AI hardware are enabling global AI implementation. The post emphasizes that AI isn't replacing humans but optimizing workflows to free employees for higher-value creative and strategic work.

Close to my heart, this area explores the backbone supporting AI innovation. Beyond GPUs, successful AI deployment requires sophisticated networking (NVLink, NVSwitch, InfiniBand) to connect 100K+ GPUs, high-speed data storage access, and edge computing for real-time decision-making. The post highlights 2025 as "the year of liquid cooling," with direct-to-chip cooling becoming essential for racks exceeding 100kW. Energy consumption remains a critical challenge, driving interest in behind-the-meter solutions including on-site power generation and sustainable energy sources.

Another exciting part of AI, this area examines where humans and digital intelligence intersect. AI-powered robotics is advancing in industrial applications, while fully autonomous distribution centers could eliminate human-focused infrastructure costs. Digital twins enable realistic simulations for training and product design, while spatial computing combines AR/VR/MR technologies for immersive experiences from retail to industrial applications.

What’s coming next? This area addresses power challenges as the biggest obstacle in AI infrastructure. Behind-the-meter energy solutions and AI-driven power optimization are becoming essential. The post also discusses specialized AI chips, modular computing architectures, emerging quantum computing applications, and the growing importance of AI security and ethics frameworks.

GTC gives us a glimpse of how NVIDIA continues to drive innovation across the entire AI ecosystem.

New Capacity Opportunities For 2025

6MW in Silicon Valley

Powered Shell

Build-to-suit

Available now

50 MW and 25 MW: Mid-West Region of The United States

Powered Shells

Build-to-suit

Ready for service in 2027

1 GW for Pre-Lease in Japan, UK and Brazil

Japan: 600 MW

UK: 200 MW

Brazil: 200 MW

The above sites are great for large-scale deployments and we have plenty of inventory for those that need a few megawatts or hundreds of kilowatts of capacity. What kind of infrastructure are you looking for? Book time here with our team to learn about what’s available.

Your Feedback Matters

At Infra Insider, we’re here to give you an edge—exclusive insights into the evolving infrastructure world that others miss. While most newsletters skim the surface, we go deeper, spotlighting the trends shaping AI, data centers, and tech capacity. Think behind-the-scenes intel, key players driving change, and actionable updates straight from the field. It’s not just another industry briefing—it’s your front-row seat to the future.

Your feedback is crucial in helping us refine our content and maintain the newsletter's value for you and your fellow readers. We welcome your suggestions on how we can improve our offering; [email protected].

Nina Tusova

Director of Customer Relationship & Success // Team Ignite

Did this newsletter bring the heat or just a little spark? Rate the intel! |

Reply